How Offshore Investment Can Offer Greater Financial Flexibility and Adaptability

Wiki Article

The Top Factors for Considering Offshore Investment in Today's Economic climate

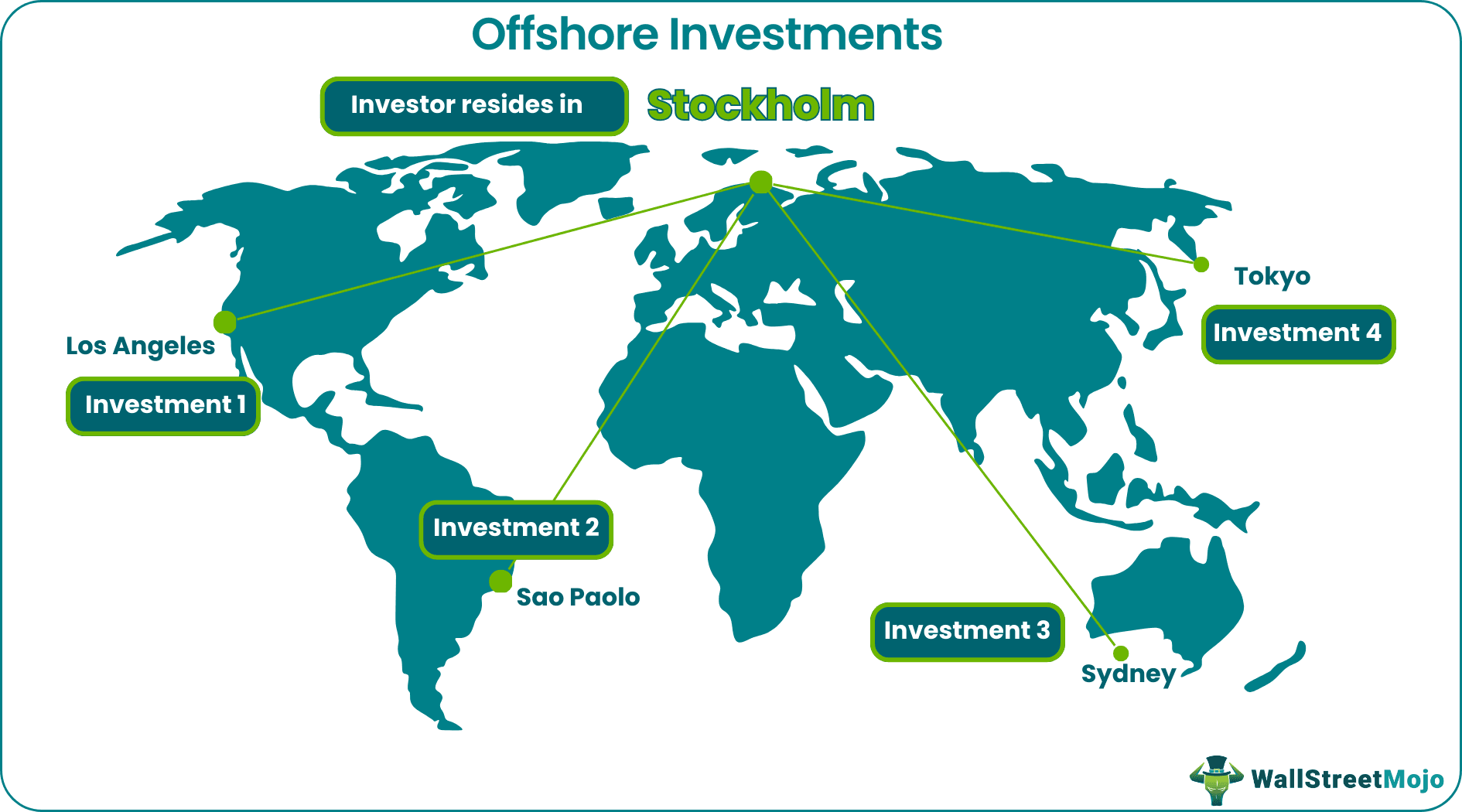

In the context these days's unpredictable economic landscape, the values of offshore financial investment warrant cautious factor to consider. Investors are progressively drawn to the possibility for diversification beyond domestic borders, which offers to minimize dangers connected with local market fluctuations. The capacity for tax advantages and boosted monetary personal privacy can not be ignored. As global markets continue to evolve, recognizing the effects of these elements comes to be critical for critical property management. What particular benefits could offshore financial investments give your profile in the existing climate?Diversity of Investment Profile

One of the main factors capitalists consider overseas investments is the possibility for diversity of their investment profile. By alloting possessions throughout different geographical areas and markets, investors can alleviate dangers associated with concentrated financial investments in their home country. This method is particularly important in an increasingly interconnected global economic situation, where financial slumps can have localized influences.Offshore investments permit individuals to use arising markets, industries, and currencies that may not come through domestic methods. As an outcome, financiers can potentially gain from unique development opportunities and bush against volatility in their regional markets. Expanding into international assets can decrease direct exposure to residential financial changes, interest rate adjustments, and political instability.

Along with geographical diversity, overseas investments typically include a series of possession courses, such as supplies, bonds, property, and alternative financial investments. This complex technique can enhance risk-adjusted returns and give a buffer versus market downturns. Inevitably, the combination of worldwide exposure and varied asset courses settings financiers to attain long-term financial goals while browsing the intricacies of worldwide markets.

Tax Benefits and Financial Savings

Offshore financial investments also provide significant tax obligation benefits and financial savings, making them an appealing choice for investors looking for to maximize their monetary methods. Several territories supply beneficial tax therapy, allowing financiers to minimize their total tax obligation liabilities. For instance, specific overseas accounts may allow tax deferral on funding gains until withdrawals are made, which can be helpful for long-term financial investment development.In addition, offshore frameworks can promote estate planning, enabling individuals to move wide range efficiently while reducing inheritance tax obligations. By making use of trusts or various other vehicles, investors can shield their assets from excessive taxation and guarantee smoother changes for future generations.

In addition, some offshore jurisdictions impose little to no earnings tax, offering opportunities for greater rois. This can be especially helpful for high-net-worth individuals and companies aiming to maximize their capital.

Accessibility to International Markets

Furthermore, spending overseas offers a special possibility to buy sectors and sectors that are prospering in different areas. Technological improvements in Asia or sustainable power initiatives in Europe can provide profitable financial investment alternatives. This geographic diversification not only minimizes dependence on domestic economic cycles but likewise alleviates dangers connected with local downturns.

In addition, offshore investment platforms commonly give financiers with a wider series of financial instruments, including international supplies, bonds, shared funds, and alternate possessions. Such a selection enables investors to tailor their portfolios according to their danger tolerance and financial investment purposes, improving total profile resilience.

Boosted Financial Privacy

While maintaining monetary privacy can be challenging in today's interconnected globe, overseas financial investment methods provide a considerable advantage in this respect. Many capitalists look for to secure their economic info from analysis, and offshore jurisdictions provide lawful structures that sustain confidentiality.Offshore accounts and investment lorries commonly come with durable personal privacy legislations that restrict the disclosure of account information. This is especially helpful for high-net-worth individuals and services looking to guard sensitive economic data from undesirable attention. Several jurisdictions additionally supply solid asset defense actions, making sure that assets are protected from possible lawful check disputes or lenders.

Additionally, the complexities surrounding global financial laws frequently suggest that details shared between territories is minimal, further boosting privacy. Financiers can make the most of various offshore structures, such as trust funds or restricted partnerships, which can provide additional layers of privacy and safety and security.

It is crucial, however, for financiers to conform with appropriate tax regulations and regulations in their home nations when making use of overseas investments. By carefully browsing these needs, people can enjoy the benefits of enhanced economic personal privacy while adhering to lawful responsibilities. On the whole, offshore financial investment can serve as an effective tool for those seeking discernment in their financial events.

Protection Versus Financial Instability

Lots of investors identify the significance of safeguarding their possessions versus financial instability, and offshore financial investments supply a feasible remedy to this issue (Offshore Investment). As international markets experience fluctuations as a result of political tensions, inflation, and uncertain economic policies, diversifying investments throughout boundaries can reduce threat and boost portfolio durability

The diversity supplied by overseas investments likewise makes it possible for accessibility to arising markets with growth potential, enabling critical positioning in economies much less influenced by worldwide uncertainties. Therefore, investors can stabilize their portfolios with possessions that may execute well during domestic economic recessions.

Verdict

Finally, the consideration of overseas financial investment in the modern economy offers countless benefits. Diversification of financial investment portfolios alleviates threats associated with residential changes, while tax obligation benefits improve general returns. Accessibility to global markets opens possibilities for growth, and boosted monetary privacy safeguards properties. In addition, offshore investments provide crucial defense against financial instability, furnishing financiers with critical placing to efficiently browse unpredictabilities. On the whole, the advantages of overseas content financial investment are considerable and warrant cautious factor to consider.

One of the main factors capitalists take into consideration overseas financial investments is the chance for diversity of their investment portfolio.In addition to geographical diversification, overseas investments commonly encompass an array of asset courses, such as stocks, bonds, genuine estate, and different financial investments.Offshore financial investments additionally use significant tax obligation benefits and cost savings, making them an attractive alternative for capitalists looking for to optimize their economic methods.Accessibility to international markets is an engaging advantage of overseas investment methods that can substantially enhance a financier's profile.Offshore investment alternatives, such as foreign real estate, international common funds, and foreign currency accounts, enable investors to safeguard their properties from neighborhood financial declines.

Report this wiki page